If the total of any nonbusiness energy property credits you have taken in previous years after 2005 is more than 500 you generally can t take the credit in 2017.

Irs federal energy tax credit 2017.

Here are some key facts to know about home energy tax credits.

Here s what you need to know when filing for tax years 2019 2020 and 2021.

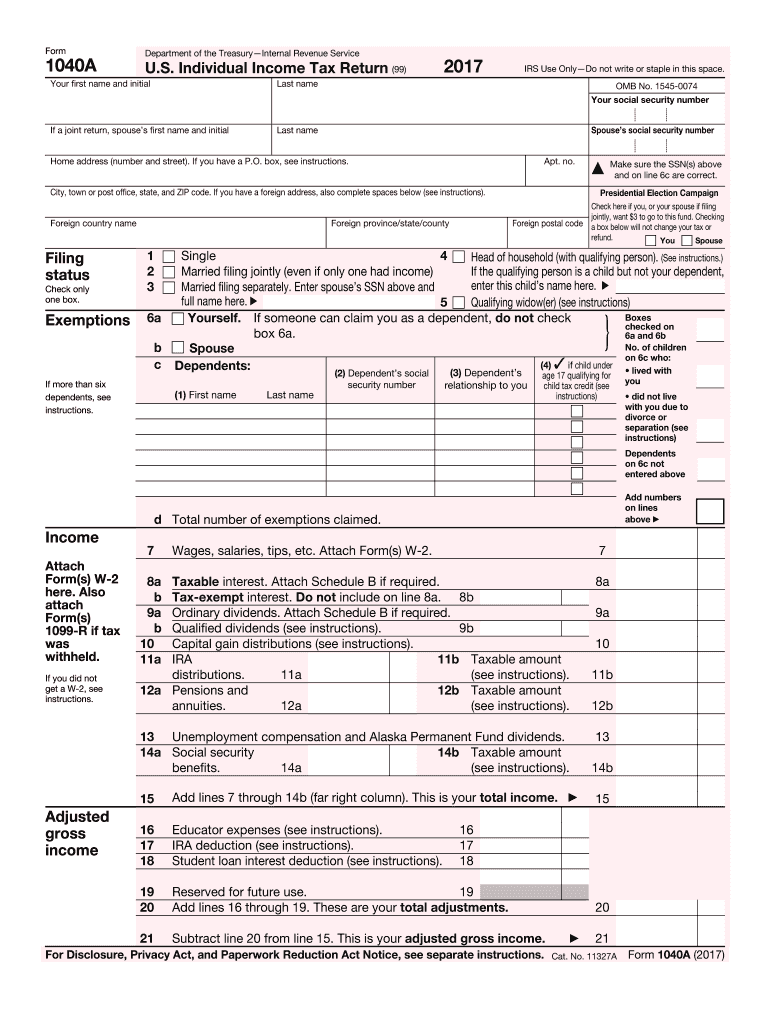

If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

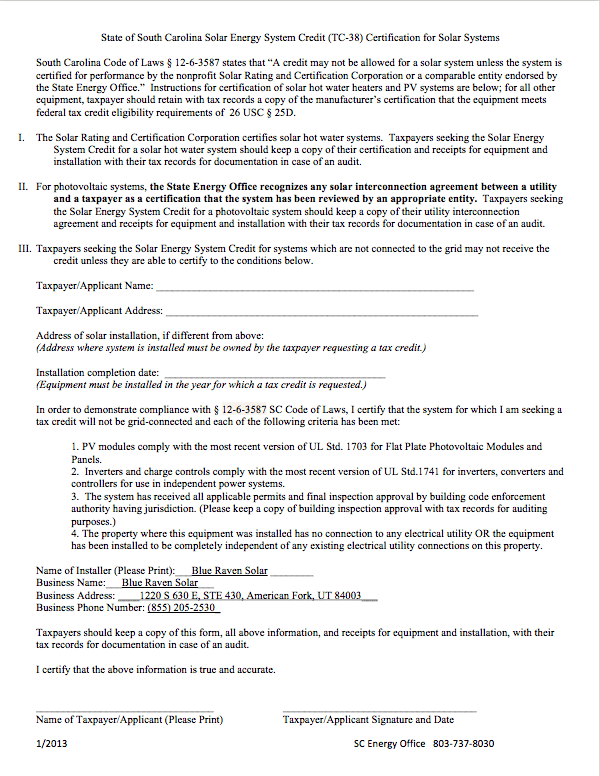

Non business energy property credit.

Any amounts provided for by subsidized energy financing can t be used to figure the nonbusiness energy property credit.

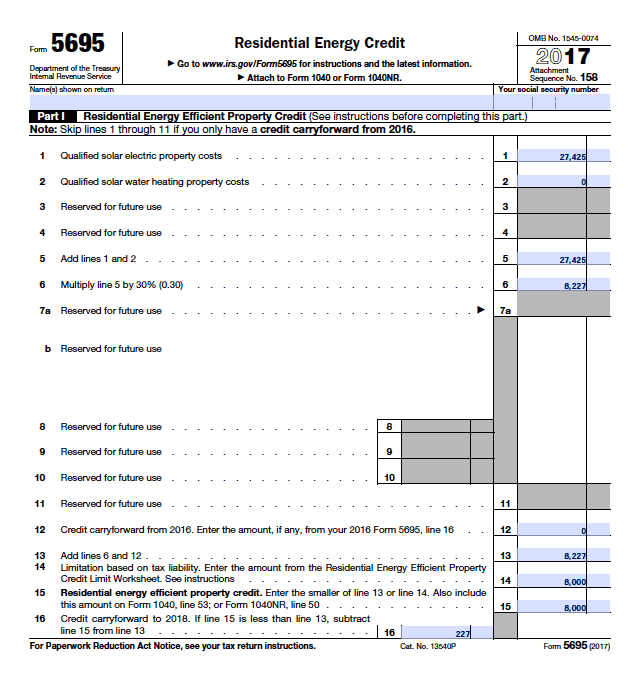

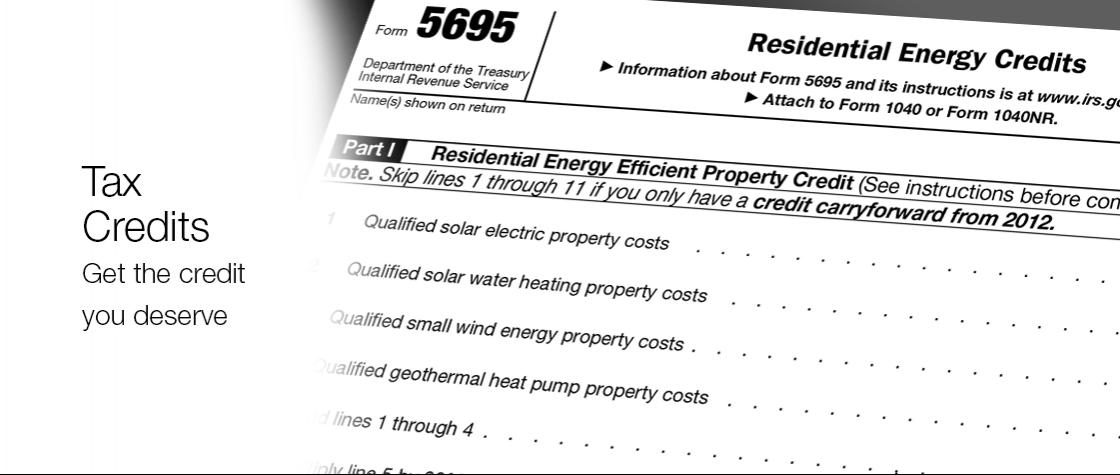

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020 tax credit.

In addition to the credit form in most cases you may also need to file form 3800.

Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules.

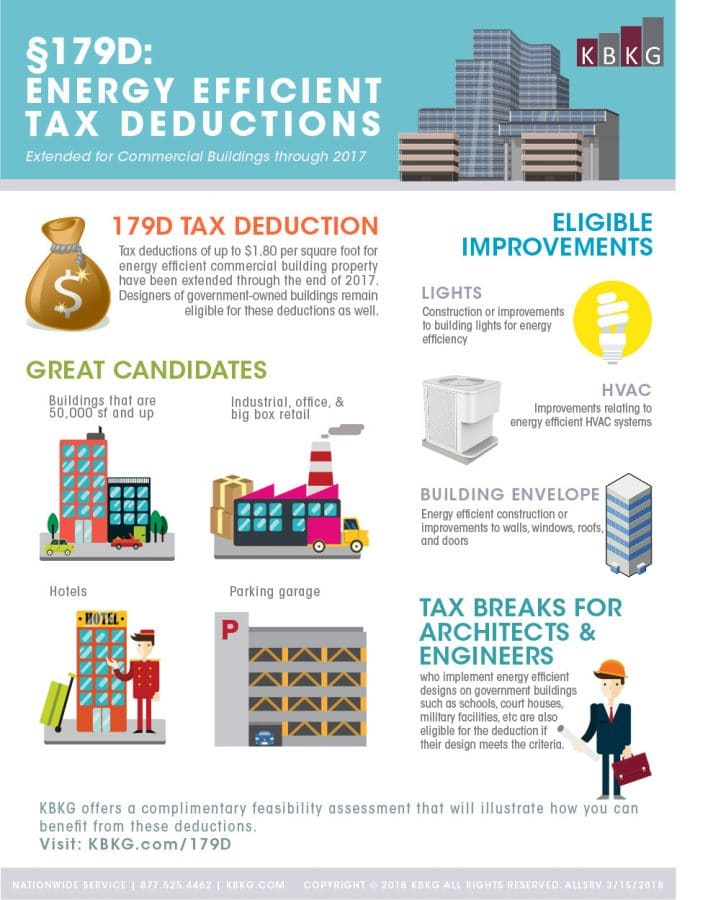

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

You may be eligible for a credit under section 30d a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14 000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source.

The residential energy credits are.

Safe harbor for taxpayers that develop renewable energy projects 29 may 2020 recent legislation has retroactively impacted the 2018 instructions for form 3468 10 feb 2020 other items you may find useful.

10 of cost up to 500 or a specific amount from 50 300.

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

Irs tax tip 2017 21 february 28 2017.