February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

Irs energy tax credits 2018.

Use these revised instructions with the 2018 form 5695 rev.

The residential energy credits are.

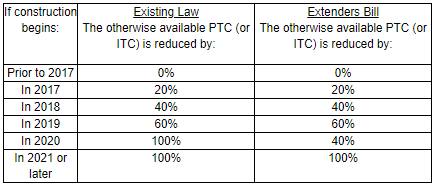

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Who can take the credits you may be able to take the credits if you made energy saving.

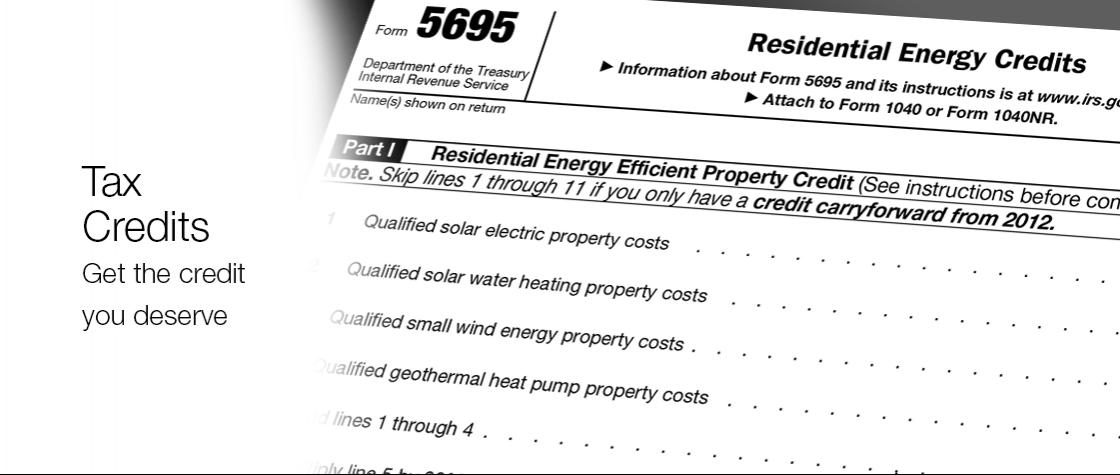

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Basics of residential energy credits several renewable energy tax credits have been extended under the bipartisan budget act of 2018 explains jacob dayan ceo and co founder of community tax.

Federal income tax credits and other incentives for energy efficiency.

Here are some key facts to know about home energy tax credits.

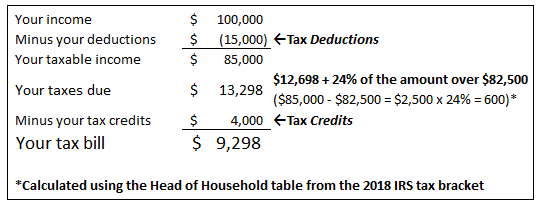

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2018 or to carry the unused portion of the credit to 2020.

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

The consolidated appropriations act 2018 extended the credit through december 2017.

Non business energy property credit.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

They ll be in effect until 2021 with a gradual step down in credit value each year.

Irs tax tip 2017 21 february 28 2017.

These instructions like the 2018 form 5695 rev.

Claim the credits by filing form 5695 with your tax return.

All of the following credits with the exception of the electric vehicle credit are part of the general business credit.

A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease.

Complete and file irs form 5695 with your tax return to claim either the residential renewable energy tax credit in current and future years or the non business energy property tax credit for prior years remembering that the tax credit no longer applies to years prior to tax year 2018.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.